Surplus team-expression lifestyle insurance plan protection offered by means of wage reduction inside a cafeteria approach and out of doors a cafeteria approach.

Paychex was founded in excess of four decades ago To alleviate the complexity of functioning a business and make our consumers' lives less difficult, to allow them to deal with what issues most. We offer: Payroll Solutions

“(3) Eligible worker.—For applications of the area, the time period ‘suitable worker’ signifies any staff who— “(A) is enrolled in the dependent treatment adaptable shelling out arrangement for the last program calendar year with respect to which the tip of the standard enrollment period of time for this sort of prepare calendar year was on or before January 31, 2020, and

. In the event the cafeteria approach delivers for forfeiture of unused elective compensated time without work, the forfeiture has to be efficient on the last working day from the system yr to which the elective contributions relate. (iv) No grace interval for paid day without work

Similarly, the payment agenda for the demanded amount for coverage under a wellbeing FSA may not be determined by the speed or amount of protected promises incurred in the course of the protection period. Employees' income reduction payments must not be accelerated dependant on staff' incurred promises and reimbursements. (2) Reimbursement out there continually.

. Employer R delivers workers with 4 weeks of paid out time off for just a yr. Employer R's calendar calendar year cafeteria plan permits personnel to exchange up to 1 7 days of paid day off to pay the worker's share of incident and wellness insurance plan premiums. For the 2009 approach 12 months, Personnel B (by using a calendar tax year), timely elects to exchange a person 7 days of compensated time off (valued at $769) to pay for accident and overall health insurance rates for 2009.

. Elective paid out time without work is made use of All things considered nonelective paid time off is applied. (iii) Cashing out or forfeiture of unused elective paid out time off, generally speaking

An employer with a bit one hundred twenty five cafeteria system in position also provides a cash-in-lieu selection separate from the cafeteria program.

To supply an easy cafeteria system, You must qualify. In case you utilized an average of 100 or less staff members during either of the two preceding years or for those who assume to hire a mean of a hundred or less staff in The existing year, you happen to be qualified.

I conform to the privateness policy. By clicking “Submit” I conform to the Phrases & Circumstances and Privateness Plan and comply with receive email messages and texts about promotions within the cell phone number and electronic mail furnished, and comprehend this consent is not essential to buy.

The QSE-HRA lets the employer offer funds being reimbursed on to the worker for their buy of overall health insurance policies on the ACA Trade or maybe the open up current market. Don't just is no health program expected, the business may not have just one at all. To find out more around the QSE-HRA, Simply click here.

To ensure that dependent care guidance for being an experienced benefit that is definitely excludible from gross earnings if elected through a cafeteria program, the cafeteria plan will have to satisfy part 125 as well as dependent care aid have to satisfy portion 129. (2) Dependent care help on the whole.

Wage reduction quantities from the final month of one system year of the cafeteria program could be applied to spend accident and wellness coverage premiums for insurance policies during the first month from the right away pursuing prepare yr, if performed over a uniform and consistent basis with respect to all individuals (determined by the same old payroll here interval for each group of contributors). (ii) Example.

(i) Staff C participates in Employer M's cafeteria prepare. Employee C timely elects wage reduction for employer-furnished accident and wellness coverage for himself and for incident and overall health protection for his former partner. C's previous spouse is not really C's dependent. A former partner just isn't a wife or husband as outlined in part 152. (ii) The reasonable marketplace value of the protection for the former spouse is $1,000. Personnel C has $one,000 includible in gross cash flow for your incident and health and fitness coverage of his former partner, since the portion 106 exclusion applies only to employer-furnished accident and health and fitness coverage for the employee or the employee's spouse or dependents.

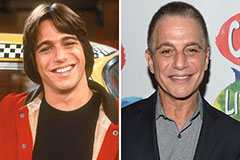

Tony Danza Then & Now!

Tony Danza Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Sam Woods Then & Now!

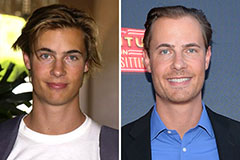

Sam Woods Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now!